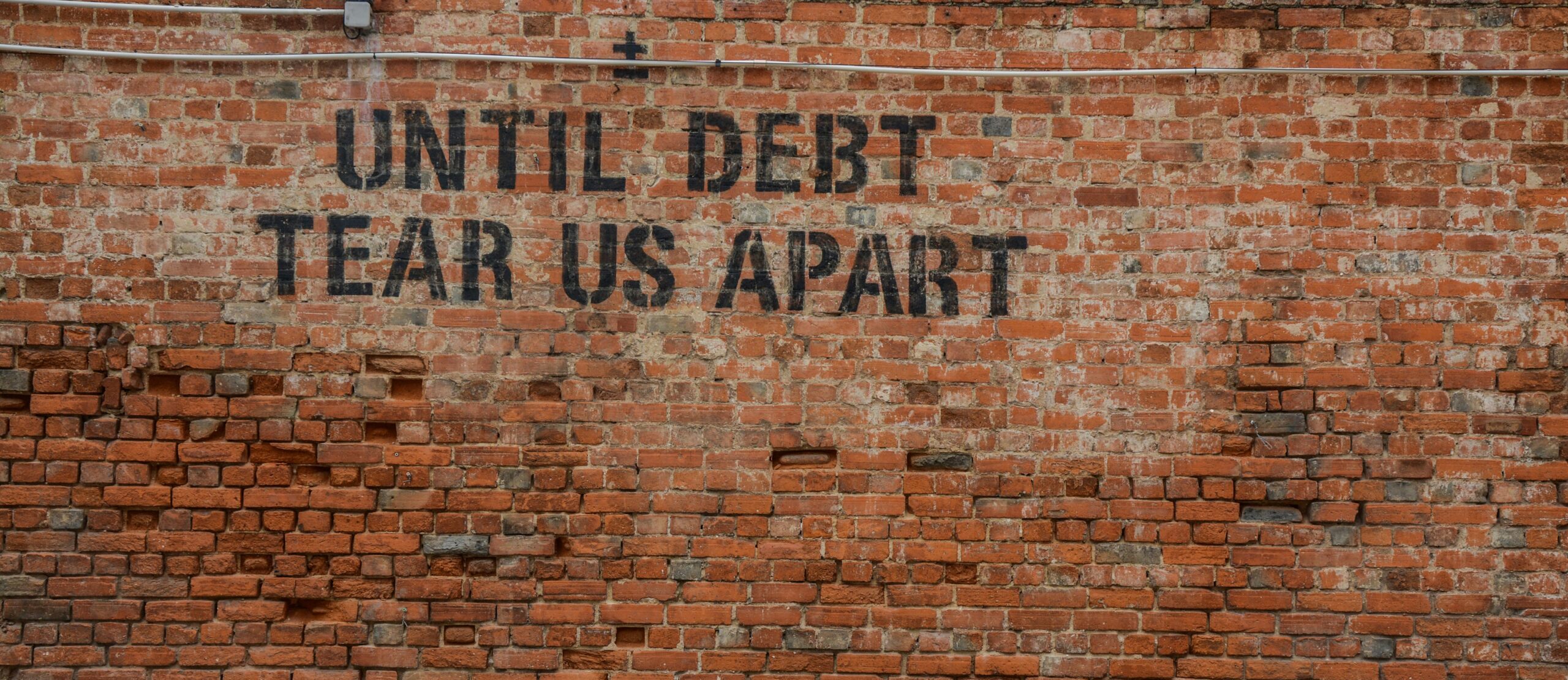

Part of pursuing That Sloth Life is also pursuing financial independence.

If we don’t have to spend any time or energy into being in the rat race, we will have more time to devote other pursuits in life. The key to being able to do that is financial independence.

I’m not going to delve a whole lot about what financial independence is — there are plenty of resources that will explain it better than I do. I do what to explain what that financial independence looks like to me, how I’m strategising for it and what’s the end goal here.

I guess the flavour of financial independence I’m leaning towards is a mix of Coast FIRE and FIRE (read more about what they are here and here.)

Essentially, FIRE is pure financial independence where you’ve saved and invested enough money that you can fully live on the returns of your investment and just retire. Coast FIRE, on the other hand, is where you have your retirement fully funded and all you have to do is let the funds grow and compound over the years until your desired retirement age. You are then free to pursue other kinds of employment that perhaps will not pay as much currently but ideally fulfils other personal desires like pursuing a passion hobby or havig the ability to work at a much reduced capacity so you can spend more time on your hobbies and other activities.

I have the option to either FIRE or Coast FIRE within 10 years. It depends on how much I’m planning to spend in my retirement years. Obviously the lower the expenses, the earlier I can reach my goals. I think the case with myself is that I love travelling, and travelling is expensive even with tips and tricks like miles hacking and paying with points etc.

Just last year, I spent around $20K because I was trying to hit the base Elite Status with Air Canada, in hopes that it will benefit me and my partner in the long-term when it comes to travelling. Lo’ and behold, it turns out we decided that we should cut down on international travelling this year to save up more, and focus more on domestic travelling, particularly on road trips.

Does this mean I regret how much I spent last year? Hell no. I will never regret spending money on experiences. However, it does put into perspective the changes in my spending when in pursuit of certain goals.

I’m not quite sure where I’m going with this post but I think this is likely going to be a series since I am still dwelling over this and I’m only just starting my journey to financial independence.